E-commerce

Quicken Review : Better Features Worth The Higher Cost?

Table of Contents

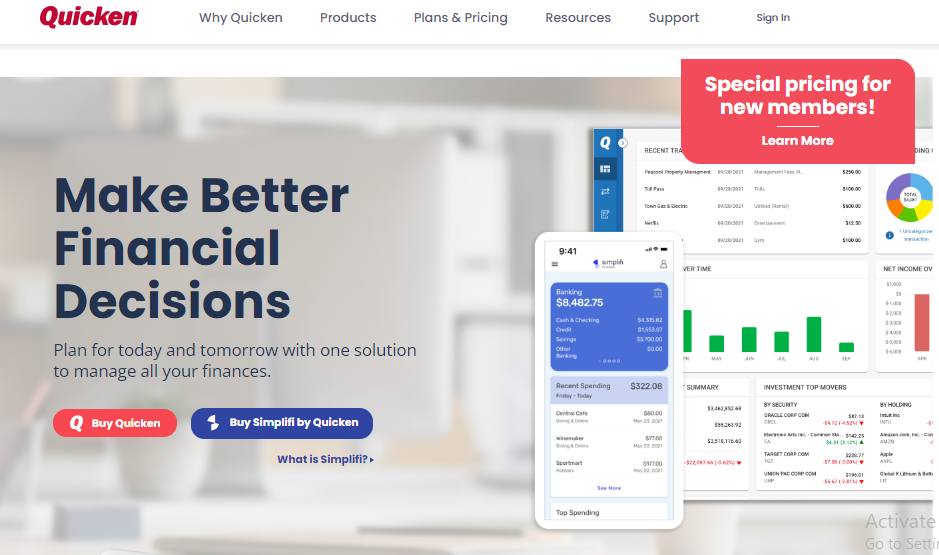

What Is Quicken?

Quicken is one of the best personal software programs available. It helps you gain control of your spending and saving so that you can live the life you want and achieve financial freedom.

Quicken has been around since 1983. It was first introduced as a DOS program by Intuit Inc, but in 2016 Quicken was sold to H.I.G. Capital.

It’s easy to use, so it’s perfect for beginners or anyone who wants to take control of their money. You connect your membership with your bank accounts, credit cards, investments, loans, and other financial institutions, so everything is automatically updated.

That way, you always know where every dollar goes and how much money you have leftover at the end of the month.

The software has come a long way since it first hit the market, and there are now different versions to suit everyone’s needs. There is a Quicken for Mac and Windows users, plus there’s a Quicken app for Android devices.

Who Benefits From Quicken?

Quicken is helpful for people who want their budget to be simple to understand and can check it on the go. Some other companies will have you pay for features you don’t need

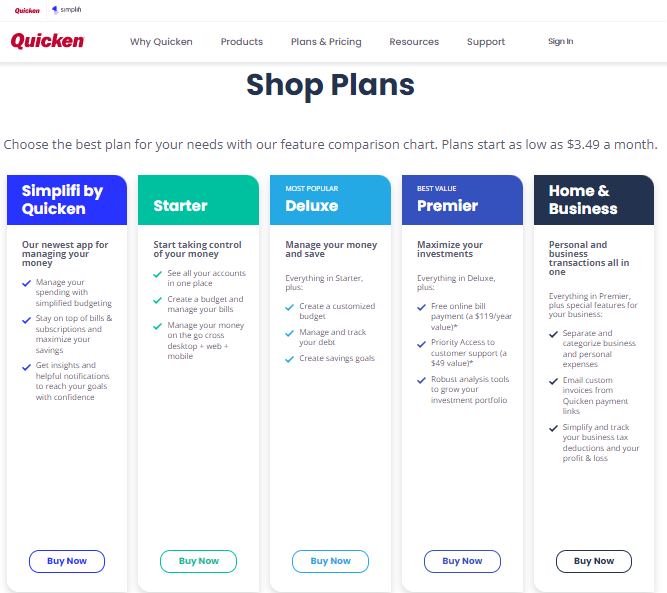

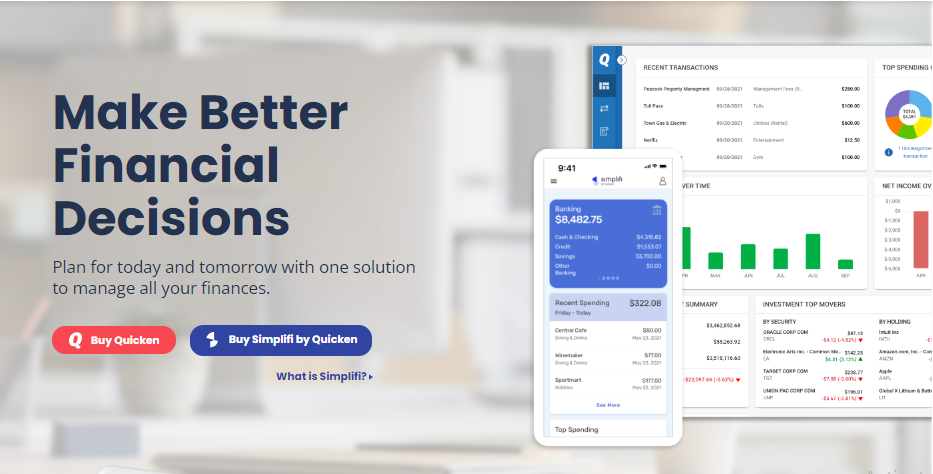

Simplifi By Quicken is the newest program designed specifically for people who are new to budgeting, who want advice on how to save and make the most out of their money. It also has automated sorting- so when you buy things, it gets placed in a category right away so you know how you’re doing. You’re out buying some groceries?

Simpifi will know, and you’ll both know right away if you’ve got to spend less on groceries! It’s so helpful to get alerts for overspending and unusual spending, Simplifi and Quicken make it easy and do all the leg work!

Now we’ve been budgeting for a very long time, but we know some of you are new to the game! Budgeting doesn’t have to be overwhelming, but it can be difficult knowing where to start exactly.

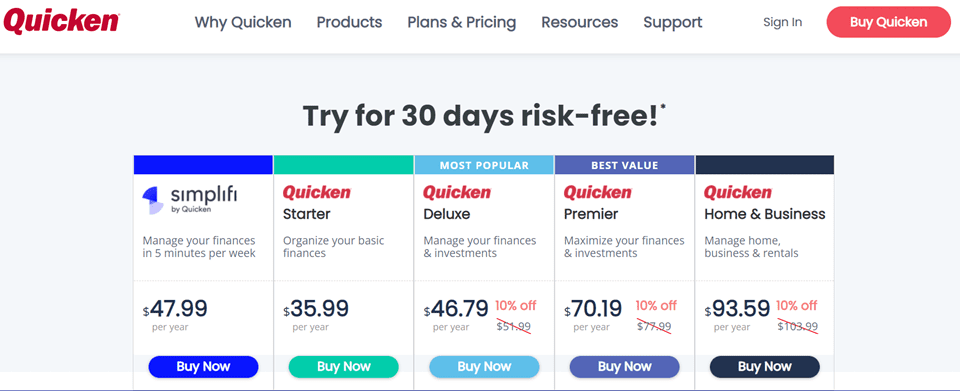

Quicken Pricing & Programs

Quicken has four packages that offer different features, ranging in price from $35.99 to $103.99.

Quicken is available at electronic stores, online on their website, or through Amazon. If you choose to subscribe to Quicken Online Service, there are automatic updates on all versions of Quicken for one year for free.

There is a 30-day money-back guarantee, but all data will be deleted from Quicken if you choose to cancel your subscription.

Each package comes with the Desktop version and Quicken mobile app. You can also create a simple one-month budget with each package, sync your bank accounts (if you want), and pay bills online with the bank bill pay feature.

The packages Quicken offers are Simplifi By Quicken, Quicken Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business. Let’s take a look at each package!

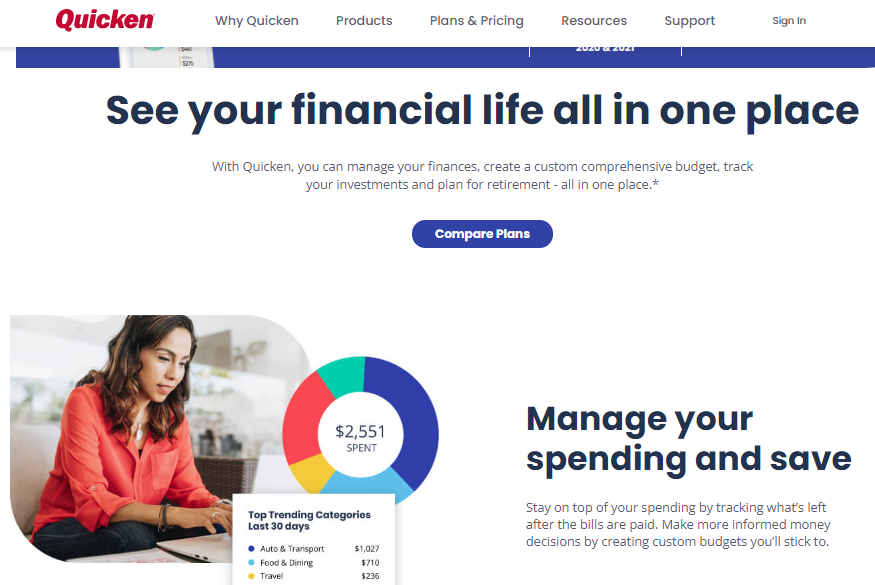

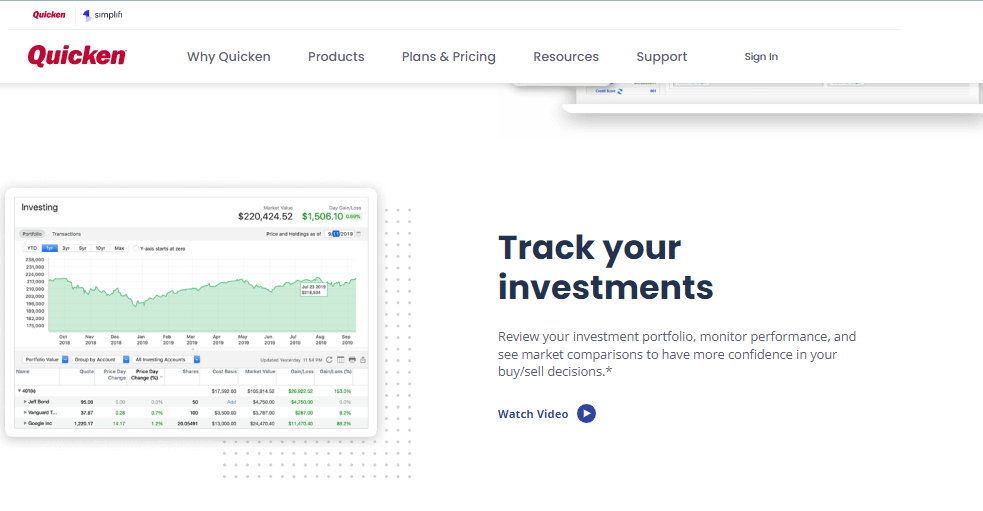

Account Synchronization

One of the best features of Quicken is that it can be synchronized with all your accounts including investment accounts and credit cards. Hooking up your financial institution or other accounts gives you the most benefits with Quicken’s features.

This means that all of your financial information is in one place, and you don’t have to worry about tracking multiple websites or software.

The synchronization process is simple and can be done in a few minutes. You enter your information on the Quicken website, and it will connect your accounts and download all of your transactions.

Then you choose which accounts and categories you want to be synced with Quicken and click “Update Accounts.”

Some people choose not to synchronize their accounts due to security concerns. Quicken gives assurance about the robust 256-bit encryption security of Quicken data transmitted.

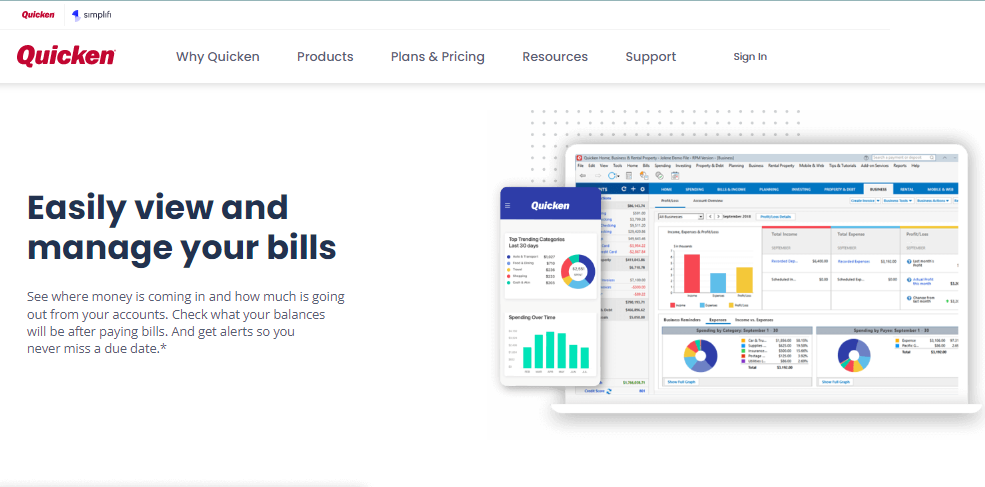

Quicken Interface

The Quicken interface is one of the most popular features of the software.

The interface is very minimalistic but has a straightforward layout that is easy to navigate. Different functions are available on the home page, but they are all tucked away neatly in one place.

If you have never used Quicken before, then there is a Resources page on their website where you can watch tutorials and get more information about various features of Quicken like One Step Update or the Investment Tracker.

Signing Up With Quicken

You can access Quicken immediately upon signing up and get all your budgets lined up quickly and efficiently.

The signup process takes about 5 minutes- all you have to do is enter your name and email address, select a password and security question, and then confirm that you accept the terms of use.

Then download the software, and you are ready to go and get your finances under wraps!

Pros & Cons

Pros

- Different versions to suit your needs – There is a Quicken for everyone, no matter your needs, and it’s usable on multiple computers, Windows devices as well as Mac products.

- It’s secure – Quicken uses bank-level security, so your information is always safe.

- A clear picture of your finances – With Quicken, you can see all your spending and save in one place. This gives you a clear picture of how much money is coming in, what bills are due, what your net worth is, and how much you can afford to spend on fun things.

- It helps you stay organized – Quicken helps keep you organized and on top of your finances, which is especially helpful if you have to keep track of multiple bills to pay or investments.

- Budgets and bill reminders – Quicken makes it easy for you to set up a financial plan by creating a budget so you can start saving more money. And you can also set up bill pay reminders to never miss a payment again.

Cons

- The program can be expensive – The full version of the software can be more than $100 for businesses, and updates and add-ons can cost extra. There are free programs and Quicken alternatives like Mint, with fewer bells and whistles, but the cost is zilch!

- Quicken can be complicated – Some people can be overwhelmed by everything Quicken offers, and it can take some time to get used to the program.

- There is an annual subscription fee – To keep using Quicken, you have to pay a yearly subscription fee. The price depends on the version of Quicken you have and the current price at the time of renewal.

Quicken Alternatives

Not everyone likes Quicken, so you can try the 30-day trial first, but you can also check out other options to track your money. If you are looking for alternative personal finance trackers, two great options are Mint and Personal Capital.

Mint is a free program that offers many of the same features as Quicken but is less complex, making it suitable for those who want a simple program to help them with their finances. Mint also has an excellent mobile app that enables you to keep track of your investments on the go.

Quicken Review Takeaways

If you’re looking for personal finance software that can help you track your spending, save money, and manage your investments, Quicken is a great option.

Overall, Quicken is a great program for personal finance that can help you keep track of your budget, bills, and investments. It has various features that cater to different needs, plus can be used on both computers, Android phones, and iOS mobile devices.

As we mentioned earlier, it is one of the most popular personal finance programs available and it has a lot of features to offer. However, it can be expensive and complicated to use, so be sure to consider all of the pros and cons before deciding if it’s right for you.