Travel

Budget Car Rental Review : Discount car rental rates and rental car deals

Table of Contents

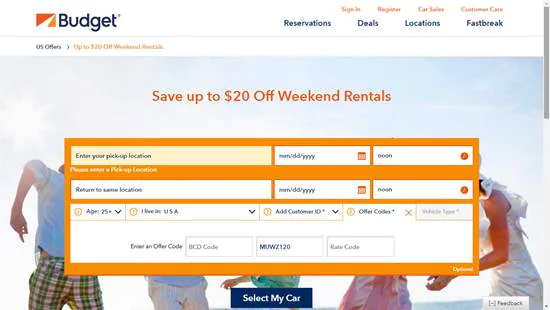

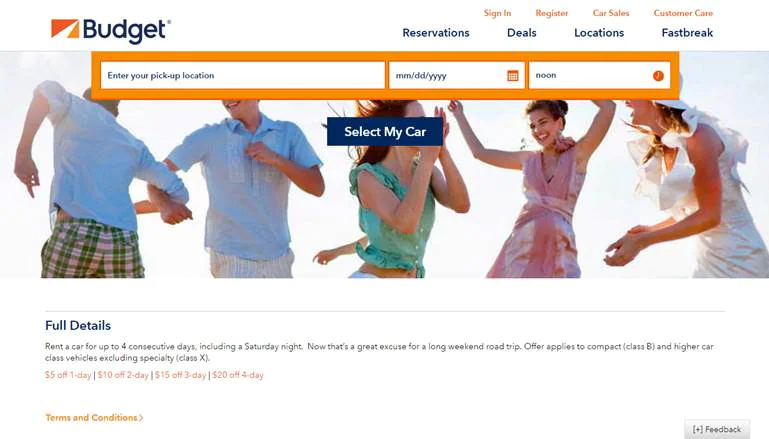

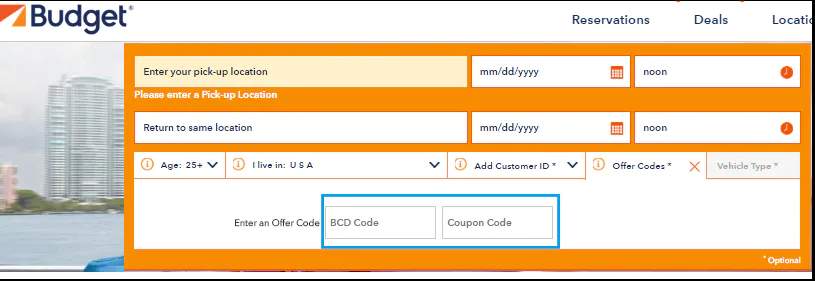

About Budget Rent a Car

To maximize our corporate contributions, we concentrate our philanthropic efforts on national organizations that serve the needs of the communities in which we operate. We welcome your requests for donations to your organization.Due to the enormous volume of donation requests we receive, it is not possible to respond to every single inquiry.

Given its name, you’d have thought Budget’s prices would be some of the lowest. They’re not.

Customers awarded it an average three stars out of five for value for money. This might be down to the cost of its additional insurance. One customer reported that excess insurance and roadside-assistance fees ended up doubling the original hire cost quoted.

Another summed this up: ‘The system is based on low prices to get you in, then extortionate add-on charges.’ Find out more about Car hire insurance.

Worse still, one customer was ‘overly encouraged to take out additional insurance’ despite already having it. This seemed to be a rare case. Other customers assured Which? that Budget staff members did not continue to upsell once they knew the customer had bought their own third-party insurance.

Budget’s customer service is a bit hit and miss depending on which office you visit. One customer recalled that staff were ‘very helpful’ and ‘trustworthy’. But overall it only received an average three out of five stars for customer service.

Several customers commented on the easy return of cars. However, the drop-off process must be slicker than pick-up, because 51% of customers reported having to queue for their car. One commented that their wait time was ‘so extreme and disheartening’ that they will avoid Budget in future, despite the rest of their experience being positive.

Overview of Budget Rent a Car

While it’s not at the very bottom of the pile, Budget is far from a star performer in our survey. Its extra costs irk customers, which is a shame as its name projects a different story. However, its returns process and clear fuel policy win it back some brownie points. For the lowest prices, we’d recommend booking a trusted local provider via Zest Car Rental instead.

Our algorithm gave the review of plan-budget.com a relatively high score. We have based this rating on the data we were able to collect about the site on the Internet such as the country in which the website is hosted, if an SSL certificate is used and reviews found on other websites.

The rating of the website indicates the site is safe to shop and leave your data. However, we cannot guarantee that the site is a scam. Many websites look legit but are in fact fake. Before you shop at a site you do not know, check the website manually.

If you really want to make a positive impact on your financial life, you need to consistently update and review your budget. But if you are new to this whole budgeting thing, you are probably wondering, how often should I review my budget?

You should review your budget a minimum of once a month. However, many people prefer to do this on a weekly basis, or every time they get paid. In addition, you should consider doing quarterly and annual budget reviews in order to fine-tune and assess your budget over longer periods of time.

Remember, budgeting is a long-term financial process, and reviewing your budget on a consistent basis is critical to your success. The key is to figure out what works well for you.

So, for the rest of this article, I am going to dive deeper into the process of reviewing your budget in hopes that it will help you find your sweet-spot, and hit the ground running.

Positive highlights

- The SSL certificate is valid (source: Xolphin SSL Check)

- This website is (very) old

- This website is safe according to DNSFilter.

Negative highlights

- The owner of the website is using a service to hide their identity on WHOIS

- According to Alexa this site has a low Alexa rank

- We tried to analyze the content of the site but failed

What Does It Mean To Review Your Budget?

Reviewing your budget is the process of assessing, adjusting and fine-tuning the amount of money you have allocated to your various budgeting categories. This small, important action gives you insight into your financial habits, and allows you to find areas for improvement.

So, if you are spending a little more money than you originally planned in one area, and a little less in another, you can tweak your budget to better align with your spending habits.

Why Is Reviewing Your Budget Important?

Reviewing your budget helps you to better manage your spending habits, increase your savings, and make progress toward your long-term financial goals. It’s an important component of proper money management, and a key element of personal finance.

Think about it, if you were to create a budget once and never review it, how would you know if you were drifting off-track in regard to your financial dreams? Additionally, how would you find areas for improvement in your spending?

Taking the time to look back and assess your budget will help you see beyond your day-to-day life, and improve your future financial decisions.

Reviewing Your Budget vs. Tracking Your Expenses

Before we get too much further into this post, I want to clarify something: reviewing your budget is not the same thing as tracking and keeping up with your budget. In fact, there is a very big difference.

Reviewing your budget is the act of analyzing how accurate and effective your budget has been, all while looking for areas to improve your budgeting process. In other words, reviewing your budget is your chance to assess what’s working, what’s not working, and how can you improve your budget. That’s why you can get away with reviewing your budget once a month.

Meanwhile, tracking your expenses (i.e. keeping up with your budget) is something you should do on a daily basis. After all, if you only track your expenses once a month, there’s no way to adjust your spending habits in time to stay within your monthly budget.

Think of it like this: reviewing your budget is how you stay on track to achieve your long-term financial goals. Whereas, tracking your expenses is how you stay on track to live within your monthly budget.

5 Questions To Ask Yourself When You Review Your Budget

Whenever you sit down to review your budget, you should answer a few very important questions. And this shouldn’t just be a quick mental conversation. Rather, I encourage you to write down your answers to the following questions every time you review your budget.

This will hold you accountable over time, as well as give you a way to look back on how much you have improved.

Oh, and one more thing, this is a time to be completely honest with yourself; no matter how difficult it might be.

What did I do well?

I like to start my budget reviews on a positive note. So, take some time to look back on the things you did well within your budget. Did you allocate the proper amount of money to each category? Did you manage to save a little more than usual this month? Did you reduce your debt by a significant margin? Did you come in under budget in any categories?

If you did something well — no matter how small or insignificant it may seem– write it down.

What didn’t I do well?

Even on my best months budgeting, I have made mistakes, or fallen short in some way. And when you review your budget, it’s important to address these mistakes.

For example, some months I spend a little too much on food. Others, I mistakenly budget less than I should have for a specific category. There are any number of things that can go wrong in between budget reviews, and now is the time to uncover them.

How can I improve?

Ok, so at this point you have written down everything that you did poorly in regard to your budget. Now, it’s time for you to address them. After all, what’s the point of a budget review if you never try to improve?

Do you need to re-allocate money to an important category?

Were there any expenses that surprised you? If so, how can you be better prepared for them in the future?

Now, just so we’re clear, these shouldn’t be theoretical answers. For example, don’t ask yourself what you can do to avoid or fix these mistakes. Rather, write down what you are going to do to ensure you don’t repeat them.

Has anything changed?

Budgets are like snowflakes, in that no two are exactly the same. For example, one month you might have a few extra expenses than the previous, and other months you might make a little more income than usual.

It’s just a fact that your budget is going to change from one month to the next. So, whenever you do a budget review, you should adjust for these changes.

Did I increase my net worth?

Let’s be honest, the overarching purpose of your budget is to manage your money so that you can increase your net worth. I mean, if your goal is to spend more money and go further into debt, you don’t need a budget, you just need a credit card. (I really hope that isn’t your goal!!)

That’s why you should track and assess your net worth every time you review your budget.

Now, there are only two ways to increase your net worth:

- Reduce your debt

- Increase your assets

So, if you paid off some debt, added money to savings, or invested money, write it down and calculate your net worth. That way, over time, you can look back on your net worth and track how far you’ve come.

Bottom Line

If you really want to make the most of your budget, you need to be intentional about reviewing and maintaining your budget. Whether that means reviewing it monthly, weekly, or every time you get paid, the most important thing you can do is stay consistent.

Finally, each time your review your budget, you should ask yourself what worked, what didn’t work, how can you improve, has anything changed, and did you increase your net worth.