Tools and software

How to pursue Accounting Foundations Graduate Certificate?

Pursuing an Accounting Foundation Graduate Certificate is a great way to gain the foundational skills you need for a successful accounting career. Depending on your course of study, an Accounting Foundation Graduate Certificate can offer access to a range of specialized knowledge and skills. If you are interested in pursuing an Accounting Foundation Graduate Certificate, be sure to check out our website. We have detailed information on all the courses and programs we offer, as well as how to apply. In addition, we provide valuable advice on what steps to take next in order to pursue your certificate.

Table of Contents

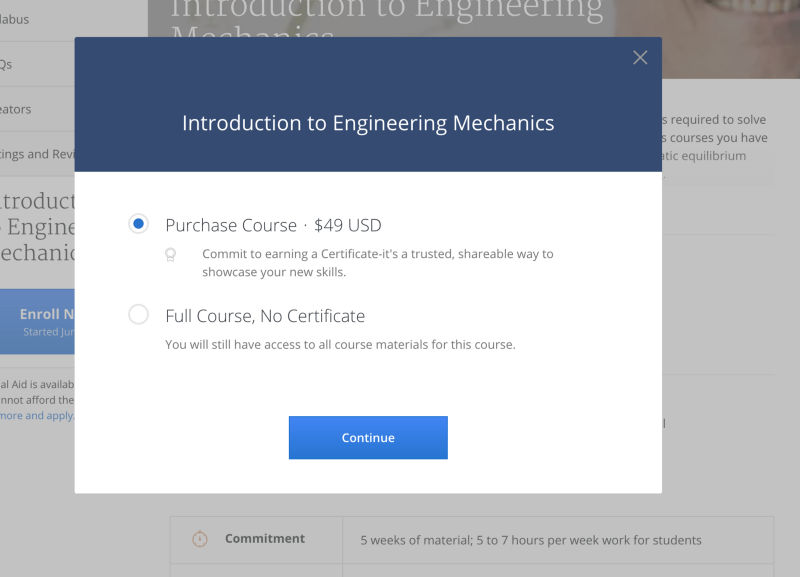

What is an Accounting Foundations Graduate Certificate?

Image Source: Link

An Accounting Foundations Graduate Certificate is a graduate level program that prepares students for entry-level accounting positions. This program is available at many universities, and can be completed in about two years. To pursue an Accounting Foundations Graduate Certificate, you will need to have a bachelor’s degree in accounting or related field. You will also need to have strong math skills and good writing skills.

The certificate program requires you to complete 18 credits in the following areas: financial accounting, managerial accounting, auditing, decision analysis, economic analysis and forecasting, taxation, business law and ethics. In addition to the required courses, the certificate program offers electives that can be used to specialize in certain areas of accounting. For example, you might choose to take electives in financial reporting, treasury and banking systems, or individual tax returns.

Once you have completed the courses required for the certificate, you will then need to pass a qualifying exam. The exam is designed to assess your understanding of the concepts covered in the program. If you are successfully registered for the exam and meet all other requirements of the certificate program, you will receive your certificate from the university at which you are completing your degree.

What are the requirements for pursuing an Accounting Foundations Graduate Certificate?

Image Source: Link

To be eligible for an Accounting Foundations Graduate Certificate, you must have a bachelor’s degree in accounting or business administration from an accredited college or university. You must also have at least two years of full-time equivalent experience working as a professional accountant. The program will require you to take 12 courses, which can be taken at any accredited college or university. Coursework for the certificate includes business law, financial accounting, management accounting, and auditing. In addition, the program will require you to complete a capstone project.

How to find an accredited Accounting Foundation Graduate Certificate program?

Image Source: Link

If you are looking for an accredited Accounting Foundation Graduate Certificate program, there are a few things to keep in mind.

First, make sure the certificate program you choose is accredited by the ACCA (Association of Chartered Certified Accountants). The ACCA has a list of accreditation bodies that certify specific programs.

Second, be sure to research the program carefully. Make sure it offers the type of coursework you are interested in and that the program has sufficient faculty resources and facilities.

Finally, ask around to see if any friends or family members have attended or know of a good Accounting Foundation Graduate Certificate program.

How to apply to an accredited accounting foundation graduate certificate program?

Image Source: Link

If you are interested in pursuing an Accounting Foundation Graduate Certificate, the first step is to research programs that are accredited by the ACCA. Programs that are ACCA-accredited provide students with advanced accounting education while maintaining stringent academic standards.

Once you have selected a program, you will need to submit an application. You will need to include transcripts from all previous colleges and universities attended, as well as your resume. You will also be required to fill out a questionnaire about your goals and motivations for pursuing an Accounting Foundation Graduate Certificate.

Final eligibility for admission into an ACCA-accredited program is based on the applicant’s GPA and other factors such as demonstrated ability in mathematics and financial accounting courses. Once admitted, you will be required to complete a minimum of 12 credit hours per semester, which may include classes offered through the certificate program itself, class sections offered through local colleges, or both. A cumulative total of 36 credit hours is required to earn the Accounting Foundation Graduate Certificate.

What are the admission requirements for an accounting foundations graduate certificate program?

Image Source: Link

To pursue an Accounting Foundations Graduate Certificate, you must have a bachelor’s degree in accounting or related field. The program offers 120 credit hours and is offered at the graduate level.

The program includes courses in business administration, auditing and financial reporting, taxation, and business law. There is also a capstone project requirement.

The program is accredited by the American Accounting Association (AAA).

What is the duration of an accounting foundations graduate certificate program?

Image Source: Link

Accreditation: Foundations certificate programs are typically accredited by the American Accounting Association (AAA). The program length is usually one year and graduates receive a certificate of completion.

Coursework: The accounting foundations graduate certificate program generally consists of 36 credits, which include foundational coursework in accounting, auditing, business law, financial accounting, management information systems, and taxation.

Program Outcomes: Upon completion of the program, students will be able to:

-Understand the basics of accounting principles

-Audit financial statements

-Understand business organization and legal issues related to accounting

-Create and use financial reports

What is the cost of an accounting foundations graduate certificate program?

Image Source: Link

The cost of an accounting foundations graduate certificate program is typically around $10,000. The program will cover topics such as financial statement analysis, auditing and compliance, business law, and enterprise resource planning. Many schools offer scholarships or family financial assistance opportunities for students who qualify.