Business

How to plan for your retirement early? Tips to consider

One of the most important decisions you will make in your lifetime is how to plan for your retirement. This article will discuss some of the things you need to consider before tackling this big decision.

Table of Contents

What are the benefits of retirement?

Image Source: Link

Retirement can be an exciting time of freedom and independence, but it’s also important to plan for your future. Here are some benefits of retirement planning:

More time for yourself. Retirement gives you more time to relax and enjoy life without worrying about work.

More time for your loved ones. You’ll have more bandwidth to spend time with your family and friends.

Fewer financial worries. A solid retirement plan will help reduce stress in your later years since you’ll know what you’re working towards.

A peaceful retirement. Retirement can be a time of calm and reflection, free from the demands of everyday life.

When can you retire early?

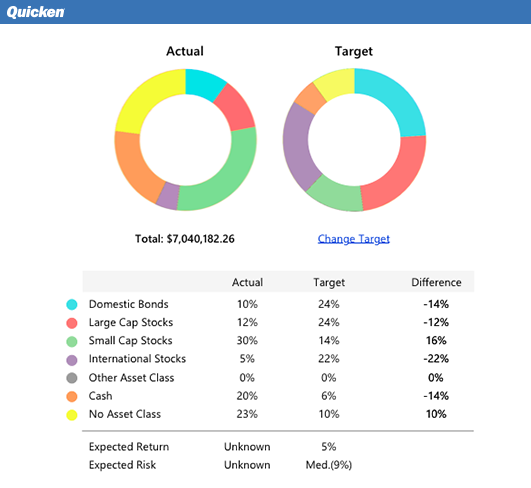

Image Source: Link

Regularly reviewing your retirement plan and making updates as needed is an important part of ensuring you are on track to retire early. Here are some things to consider when planning your retirement:

- Determine how much money you will need in order to live comfortably in retirement. This includes estimating your required Social Security benefits, pension income, and other savings.

- Review your health and disability insurance policies to ensure they cover you if you cannot work due to illness or injury.

- Review estate planning documents, such as wills and trusts, to ensure they are in order and protect your assets should you pass away prematurely.

- Evaluate your current spending habits and make adjustments where necessary so that you have enough money saved for retirement. Avoid unnecessary expenses such as eating out frequently or shopping for luxury items.

- Consider taking a reduced workload approach to work during retirement to conserve energy and stay healthy. This may include reducing the number of hours you work each week, taking time off occasionally, or retiring completely at a certain age if possible.

How much money does it take to retire early?

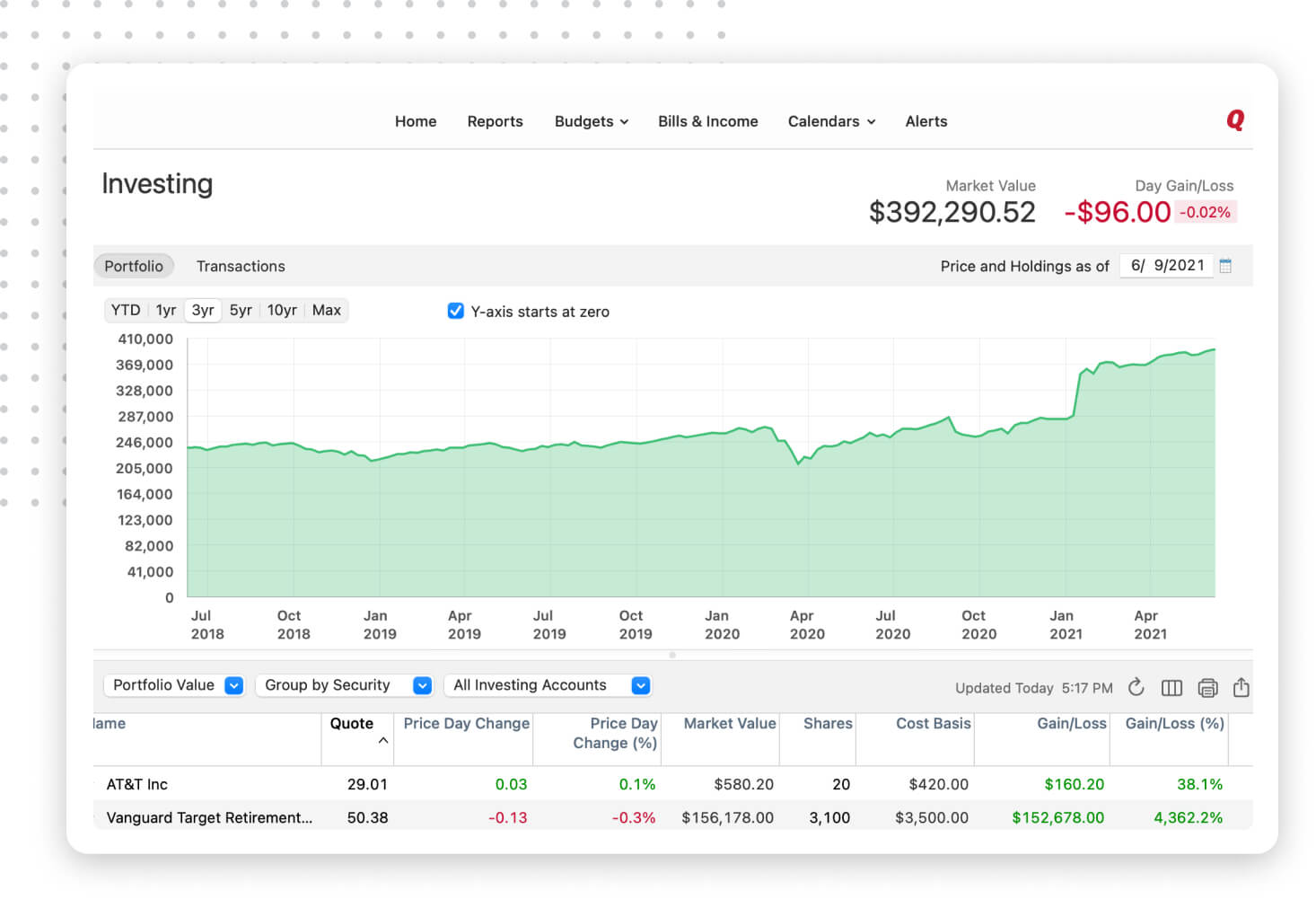

Image Source: Link

Retirement planning is a big decision that must be made well in advance. There are many factors to consider when figuring out how much money it will take to retire early. The calculations can vary depending on your income, expenses, and investment returns. However, the following are some general tips to help you get started:

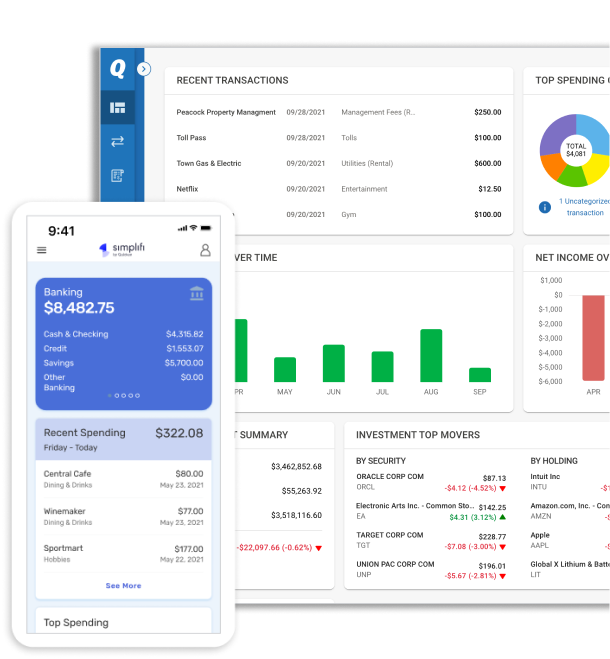

- Calculate your retirement income goal. This is important because you need to have a ballpark figure before saving for retirement. You can use an online calculator like PENSIONWIZARD or personal finance software like Quicken or Microsoft Money.

- Figure out your expenses. This includes taxes, Social Security payments, health insurance premiums, and retirement savings contributions. You also want to include everyday costs like groceries and utilities. Add up all your monthly expenses and divide that by 12 to find your monthly budget limit.

- Determine how much money you need to save each month from reaching your retirement income goal by age 65 or 70 (depending on when you plan on retiring). For example, if you want $50,000 per year at age 65, you would need to save $5,000 per month ($50,000 ÷ 12 = 5,000). Save more if you want more money each year later in life, and less if you want less money each year later in life.

- Invest your money wisely for the long term. Consider picking stocks or mutual funds that will grow your money long-term. Don’t put all of your eggs in one basket by investing only in stocks. Also, make sure you contribute enough to your monthly retirement savings account.

- Make a plan and stick to it. It can be tough to save for retirement every month, but if you start early and keep up the effort, you will reach your retirement income goal.

Ways to fund your retirement early?

If you’re considering retiring early, there are a few ways to fund your retirement. Here are four tips to get started: 1. Save for retirement early. Start saving for retirement as soon as you can, and make sure you have enough money saved up so that you can retire comfortably. The earlier you start, the more money you’ll save. 2. Invest in stocks and mutual funds. Investing in stocks and mutual funds is one way to make your money work longer while providing long-term growth opportunities. 3. Use assets such as real estate or gold coins to generate long-term returns. These assets tend to provide stability and income over time, which can help supplement your savings or retirement income. 4. Consider taking out a reverse mortgage or using home equity lines of credit (HELOCs) to help pay for your costs during retirement. These options allow you to tap into your home’s value without having to sell it outright, which can be helpful if you want to stay in your home long-term.

If you plan on retiring soon, there are several ways to save for the future while also earning an added return on investment (ROI). One option is to invest in stocks and mutual funds through various brokerages or online platforms; this option allows for both short-term liquidity and potential capital gains and dividend payments over time should the stock market perform well during your tenure as an investor. Additionally, property investments, including real estate and gold coins, may provide a higher degree of stability and yield over time and opportunities for capital appreciation. To utilize these assets in the most efficient way possible, it may be beneficial to consider taking out a reverse mortgage or utilizing HELOCs (home equity lines of credit). By doing so, you can reduce your monthly payments while also having access to the home’s underlying value should you choose to sell in the future.

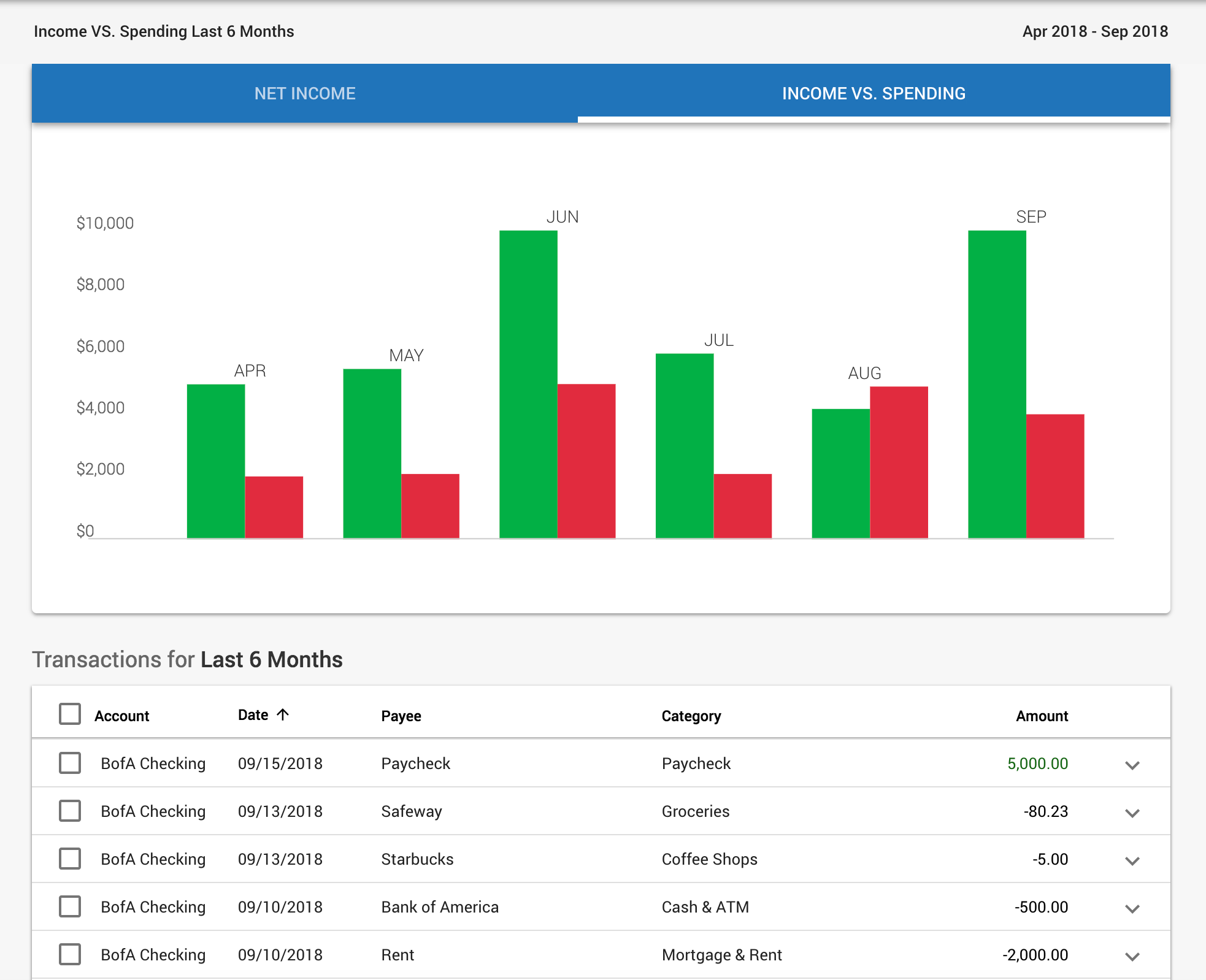

Common mistakes people make when planning for their retirement

Image Source: Link

Many people don’t start planning for retirement until they’re already in their 70s or 80s. But you don’t have to wait that long to get started. There are a few things you can do now to make sure your retirement is as comfortable and financially secure as possible.

One common mistake people make when planning for their retirement is overestimating how much money they’ll be able to save. The average person expects to retire with $200,000 saved, but most people only have half saved by the time they retire. So if you’re considering retiring soon, make sure you’re also factoring in how much money you’ll need each month to live comfortably.

Another mistake is not considering how dependent they will be on others once they retire. For example, if you plan on living in a home owned by your spouse or partner, your retirement may be significantly affected by whether or not he or she continues to live there after you leave. This could be a major setback if you’ve planned your retirement around having full control of your finances and living alone.

Finally, many people don’t consider how changes in the economy can impact their ability to retire comfortably. For example, if the stock market crashes and your 401(k) loses 50% of its value, that could mean a significant decrease in income when you finally decide to retire. It’s important to stay up-to-date on changes in the market so you can make informed decisions about your retirement savings.

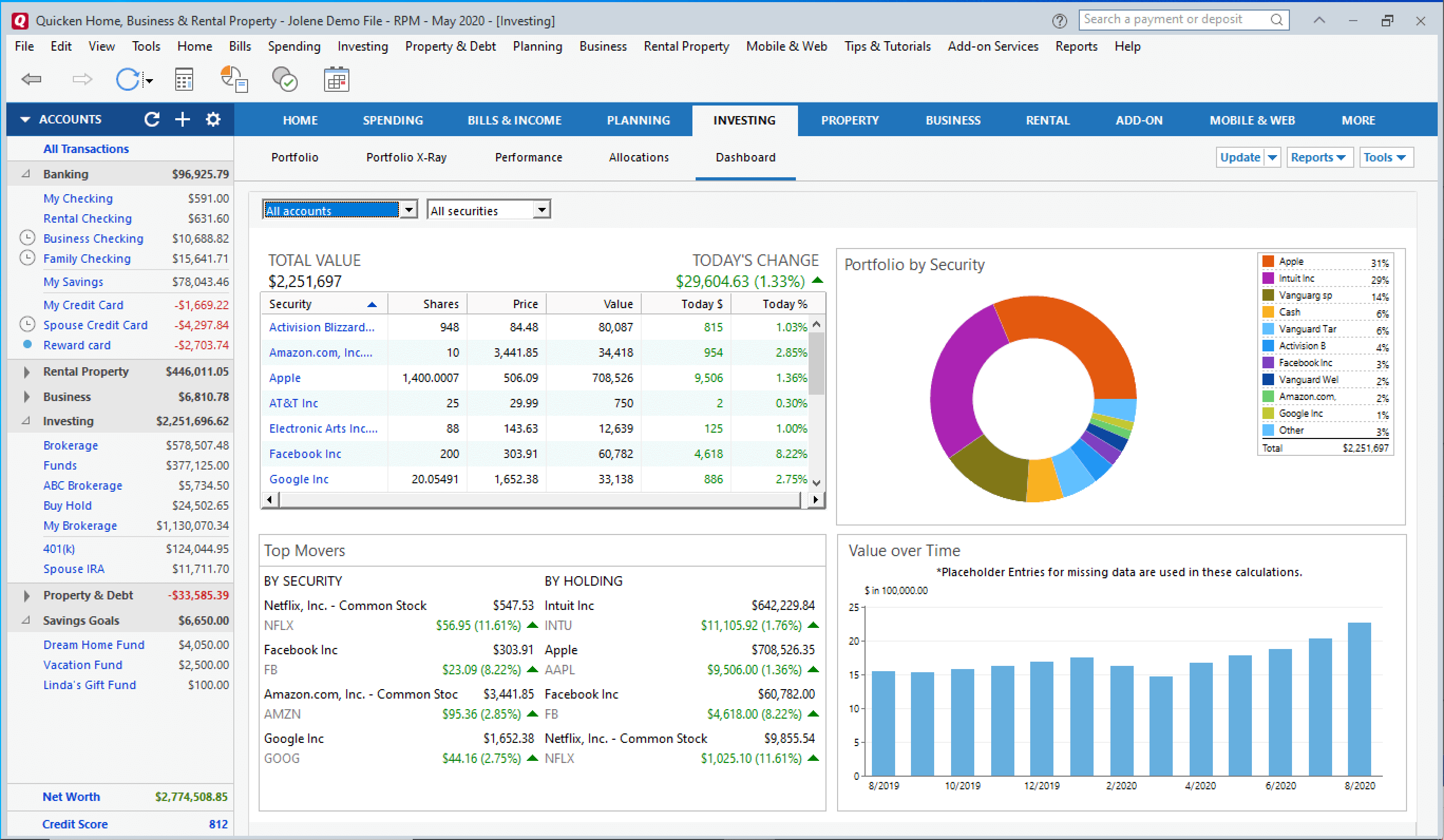

Conclusion

Image Source: Link

Retirement is looming ever closer, and it can be intimidating to try and figure out what steps you should take to ensure everything goes as planned. There are a few key things to keep in mind when planning for your retirement, including ensuring that you have enough savings saved up, making sure you have an accurate estimate of how long you expect to live, and thinking about what kind of lifestyle adjustment you might need to make to afford the life of leisure after work. By taking these steps early on, you will be well toward a worry-free retirement!